The WhipSaw Blog

Volume 1, Number 1

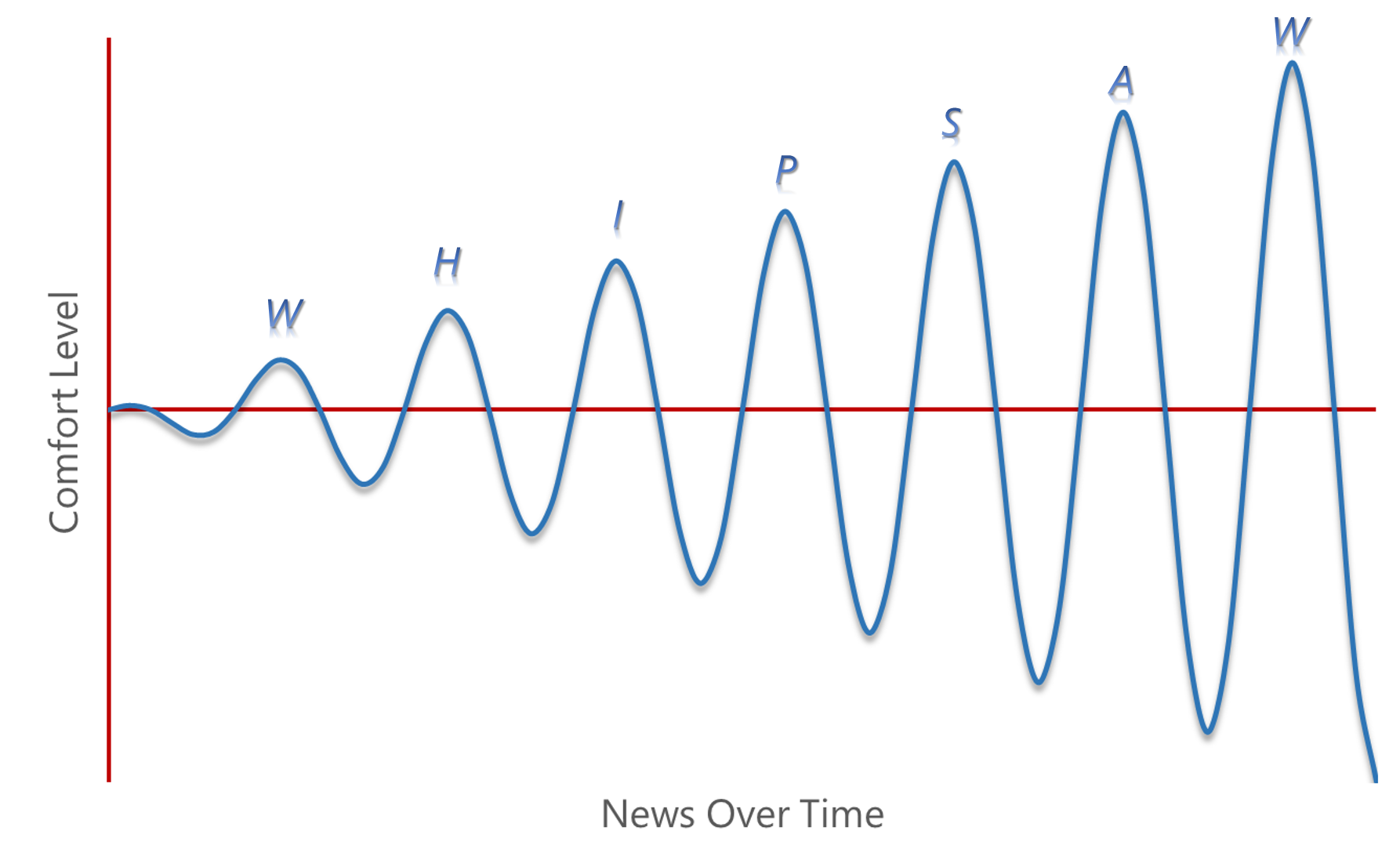

Getting whipsawed by the COVID-19 economic and health news? Me too.

Last week was the Dow’s Best Week since 1938! – More that 16M Americans Have Lost Jobs in 3 Weeks!

It’s hard to know how to react to two stories that paint such different pictures of the U.S. economy. Early return from the lockdown, or rolling re-entry? Supply chain disruption for some industries? New modes of working from home or business as usual? Hire or furlough? It’s certainly hard to plan ahead or to know what steps an executive can take that would be prudent.

The health-related news is just as bewildering. The turbulence in the financial literature is only a bit more entropic than the agitation in the medical field. Drugs used for Ebola might or might not mitigate the effects of having COVID-19. We’re not sure how COVID-19 is transmitted, but now tigers in zoos are getting it from their keepers. I would have social distanced from a tiger anyway. Don’t wear masks; do wear masks. Scarves—preventative or fashion statement?

What This Blog is About

This blog is about trying to find common sense as a nugget in the swirl of news, good and bad. As a lender, as a small-business owner, or as a human resources director, what should you expect and when? As I thought about writing this, I was overwhelmed by the question: why would anybody want to read what I have to say when there are so many blogs out there, and so many on coronavirus and COVID-19.

This set me back. What do I have to say that is unique and helpful? How can I avoid creating more discord and eschew the polemics? The short answers are:

- I take the long view. Not for the economy but for a business trying to exist in a broader space. I don’t know what will happen in the next month, but I can anticipate what happens long term, given a set of inputs.

- I combine epidemiologic and economic viewpoints since I work in both arenas.

- I list my assumptions before I build from them to forecast where I think we’re going. If you don’t like the assumptions I make, you’re welcome to respond with your own.

Assumptions About the Future

There are a few assumptions we can use to launch a conversation:

- A vaccine will eventually be developed, but we don’t know when. Best guess, twelve months. Deaths from COVID-19 will decline, but quarantining will continue to be necessary.

- Some employers, like Rite Aid, CVS, Walmart and Amazon, are currently ramping up. The people they are hiring won’t be available to their old employers.

- Employers will bring back the remaining labor—but not everyone—and in phases.

- Prices on many items will drop to induce people to buy stockpiled goods. Given the two year supply of toilet paper that everyone stockpiled, demand will slump. Not to mention seasonal goods that are sitting at retailers. What demand will there be for those?

- Wage reductions will follow price reductions. If a business is hiring people who are currently unemployed, low wages will follow in a flooded labor market.

Business Cycles and Health Cycles

This is a textbook example of the development of business cycles. This is the inception of two such cycles. We have the following sequences and interactions between them.

Cycle 1 – Business Profit Effects

- People buy less while under quarantine (demand is down)

- Stockpiles of goods develop (supply is up)

- Prices fall to attract buyers (profits way down, costs of storage and maintenance up)

- Workers laid off (no income)

Cycle 2 – Worker Income Effects

- Pool of unemployed is huge, creating competition to get hired (wages down)

- Workers hired but at lower wages, fewer benefits

- Purchasing power is devastated (workers laid off, profits vanished)

- Fewer goods purchased by laid off workers and at lower prices, so profits are down

- Fewer workers hired to compensate for low profits, wages remain suppressed

Not all businesses will survive these cycles. Those that do survive won’t be as profitable. Workers will be strained due to lower wages, higher uncertainty. They’ll save more, buy less. That makes businesses less profitable, so they can’t increase worker pay. And so on.

I’m sure you get the idea: it’s a tough climb. There is a valley in the economy, and we’re not even sure we’re at the bottom yet. There are two other factors that make a recovery more difficult:

- The simple model given above happens to different sectors of the economy at different times. One sector feeds another, meaning that there will be a continuing ripple through the economy.

- Return from work at home too early may trigger a new spike in infections. A new spike can mean new restrictions that would last longer than if we had just not rushed back.

We’re three to four weeks in on working from home and social distancing, meaning we’re also about three weeks in on furloughs and layoffs. We can consider past, present and future effects just based on the few assumptions I gave previously. These will set us up to consider what should be happening now and what we can expect over time.

Past Economic and Health Related News

As noted above, 16 million people were laid off in three weeks. Out of about 162 million in the labor force, that’s 10%. Except that we don’t know how many people remain in the labor force. The number of people who are actively in the labor force—meaning they are employed or looking for a job—will decline as people leave the labor market, shrinking the overall pool of workers. With fewer people working and many more just giving up, the economy must shrink.

Oil prices are their lowest in decades. 81 cents for a gallon of gas in Oklahoma, and nationally $1.89 per gallon. This should be a boon to all other sectors of the economy, except no one is driving, no one is flying, and cruises are on lock-down as ordered by the CDC. Ordinarily, if prices drop, demand goes up. But as there is no demand right now, nobody benefits, and the energy industry is suffering. Oil is being massively stockpiled.

Japan, China, and Singapore have all announced a resurgence of COVID-19 after each country relaxed restrictions. Social distancing worked well, until it was stopped because it had worked well. There’s a Catch-22 aspect to the pandemic.

New York City, the State of Washington, and other areas have announced that they are near or at the peak of new cases of and deaths from COVID-19. Being at the peak means that it’s the most they expect to see. However, just as it took some time to get to the peak, it will take some time to trek down to pre-pandemic levels.

The National Multifamily Housing Council announced that for April 2020, about one-third of renters had not paid their rent as of April 5th. There’s no relief offered for renters yet, except through the kindness of their landlords. Mortgage payments, however, could be delayed if the infrastructure in the U.S. could keep up with the demand. The Mortgage Bankers Association reported that requests for mortgage forbearance rose by 2000% (yes, that’s two thousand) in a two-week period. Freddie and Fannie both say that lenders should offer forbearance for up to 12 months with the possibility of a loan modification afterwards.

If we focus just on these last two paragraphs, we see a large swath of the economy affected. Payments to lenders, servicers, and landlords are greatly reduced and will be for an indeterminate time. Cash flow from renters and home mortgage holders is greatly diminished. With no cash flow, apartment complex owners, investors who are renting single family homes, and banks or servicers have much less money coming in. But their expenses continue. Employees have to be paid. Servicing of rent payments continue, as well as repairs, maintenance, and regular payments like electricity, water, or other services included with apartment rental. To conserve cash, apartment complex owners and loan servicers dealing with properties already in foreclosure may lay off some personnel and will cut back on services that can be deferred. This means fewer people are paid for regular maintenance, and the economy continues to slow down.

In turn, people performing maintenance or repairs are not able to maintain their staffs, are not buying equipment they would use, and are no longer able to pay their bills, including rent of commercial space and even their own rent or mortgage payments. To continue to maintain their households, they draw down on savings but no longer deposit payments they have received. And they are unable to make payments on credit cards and other forms of debt.

If you are a lender and have a portfolio of small business loans or other types of commercial debt, the real question you face is how your cash flows will be affected in the future. In a study we did for the Small Business Administration, we found that many small businesses offer their own properties (their homes) as collateral for business loans. Can you, as a lender, foreclose on a home loan if a small business is unable to pay? If so, would it avail you to force the small business into bankruptcy, now or in the future, and obtain an asset that is worth less than the debt amount and will continue to decline in value while no home sales are being conducted? Is forbearance a better option, and if so, how long for a small business on the edge? Will the value of the underlying collateral recover, and when?

You get the idea. Put yourself in the position of a business like a lender or a small service business. When can you expect that the recovery will come to you, and where do fit in the waves of business inactivity that keeps you from fully recovering? Future blogs will examine more formal ways to examine these questions.

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Unbelievably user friendly website. Enormous details readily available on couple of clicks on.